schedule 13e 3|13e 3 transaction statement : iloilo The issuer or affiliate engaging in a Rule 13e-3 transaction must file with the . WEBnovo. 97% RTP. Aviator. Jogue aqui. Aviator. Desenvolvido pela Spribe, o Aviator tornou-se um dos jogos de crash multiplayer mais populares nos cassinos do Brasil – famoso pelo seu nome popular “Jogo do Aviãozinho”.

0 · sec rule 13e 3

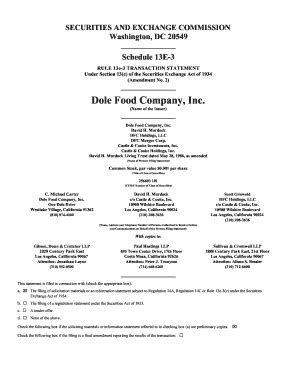

1 · schedule 13e3 pdf

2 · schedule 13e 3 transaction statement

3 · schedule 13e 3 form

4 · rule 13e 3 transaction statement

5 · insider privatization

6 · going private transactions exchange act

7 · More

8 · 13e 3 transaction statement

La cantidad máxima por retirada a través de cajero automático es de 300£, con un límite diario de 1.000£ en total La cantidad máxima de saldo que podrá tener en todo momento en la tarjeta bet365 Mastercard es de 10.000£. Para ver toda la información sobre .

schedule 13e 3*******If the Rule 13e-3 transaction involves a series of transactions, the issuer or affiliate must file this statement at the time indicated in paragraphs 1 through 4 of this Instruction for the .(g) The requirements of section 13(e) (1) of the Act and Rule 13e-4 and Schedule .

The issuer or affiliate engaging in a Rule 13e-3 transaction must file with the .

The issuer or affiliate engaging in a Rule 13e-3 transaction must file with the Commission: (1) A Schedule 13E-3 (§ 240.13e-100), including all exhibits; (2) An amendment to . Question: When should the Schedule 13E-3 in a “going private” issuer tender offer be filed? Answer: General Instruction D.3 to Schedule 13E-3 provides that .

In addition, if Rule 13e-3 applies, the transaction is subject to heightened disclosure requirements and certain waiting period requirements under federal law. The .

If the Rule 13e-3 transaction involves a series of transactions, the issuer or affiliate must file this statement at the time indicated in paragraphs 1 through 4 of this Instruction for the .

(3) A Rule 13e-3 transaction is any transaction or series of transactions involving one or more of the transactions described in paragraph (a) (3) (i) of this section which has .13e 3 transaction statementSchedule 13G—Information to be included in statements filed pursuant to § 240.13d-1(b), (c), and (d) and amendments thereto filed pursuant to § 240.13d-2. § 240.13e-1 .

SEC Schedule 13E-3 is a form that any publicly traded company or an affiliate must file with the United States Securities and Exchange Commission (SEC) when “going private.” A company may .

General Instructions: File eight copies of the statement, in-cluding all exhibits, with the Commission if paper filing is permitted. This filing must be accompanied by a fee .We would like to show you a description here but the site won’t allow us.

Under Schedule 13E-3, certain disclosures are mandated to be provided to shareholders during the course of a tender offer. These disclosures aim to provide shareholders with the necessary information to make informed decisions regarding the offer. Some of the key required disclosures include: 2.1. Terms of the Offer.Rule 13e–3 transaction. If those forms or schedules require less information on any topic than this statement, the requirements of this statement control. I. If the Rule 13e–3 transaction involves a tender offer, then a combined statement on Schedules 13E–3 and TO may be filed with the Commission under cover of Schedule TO (§240.14d–100).The Filing Persons are filing this Schedule 13E-3 because the ADS Purchase, in light of the formation of the Consortium and the Proposed Transaction, may be viewed as a step in a series of transactions having the reasonable likelihood or purpose of producing, directly or indirectly, one or more of the effects set forth in Rule 13e-3(a)(3)(ii . SEC Schedule 13E-3 is a form that any publicly traded company or an affiliate must file with the United States Securities and Exchange Commission (SEC) when “going private.”. A company may choose to go private for several reasons and implement various mechanisms, like a tender offer or asset sale. Events qualifying for delisting .If the Rule 13e-3 transaction involves a tender offer, then a combined statement on Schedules 13E-3 and TO may be filed with the Commission under cover of Schedule TO (§ 240.14d-100). See Instruction J of Schedule TO (§ 240.14d-100).The issuer or affiliate engaging in a Rule 13e-3 transaction must file with the Commission: (1) A Schedule 13E-3 (§ 240.13e-100), including all exhibits; (2) An amendment to Schedule 13E-3 reporting promptly any material changes in the information set forth in the schedule previously filed; and. (3) A final amendment to Schedule 13E-3 .

13e–3 transaction must file with the Commission: (1) A Schedule 13E–3 (§240.13e–100), in-cluding all exhibits; (2) An amendment to Schedule 13E–3 reporting promptly any material changes in the information set forth in the schedule previously filed; and (3) A final amendment to Schedule 13E–3 reporting promptly the results of(a) Fairness. State whether the subject company or affiliate filing the statement reasonably believes that the Rule 13e-3 transaction is fair or unfair to unaffiliated security holders. If any director dissented to or abstained from voting on the Rule 13e-3 transaction, identify the director, and indicate, if known, after making reasonable inquiry, the reasons for the .

schedule 13e 3 13e 3 transaction statementThe date on which a potential acquiror or acquiror group may be required to file or update a Schedule 13D and make public its intent to undertake, or consideration of, a going private transaction. The differences resulting from who (the bidder or the target’s board of directors) initiates the going private process.

J. If the tender offer disclosed on this statement involves a going-private transaction, a combined Schedule TO (§ 240.14d-100) and Schedule 13E-3 (§ 240.13e-100) may be filed with the Commission under cover of Schedule TO. The Rule 13e-3 box on the cover page of the Schedule TO must be checked to indicate a combined filing.Introduction . This Amendment No. 10 (the “Final Amendment”) to Rule 13E-3 Transaction Statement on Schedule 13E-3, together with the exhibits thereto (the “Transaction Statement”), is being filed with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (together .schedule 13e 3 1. Purpose and Overview of SEC Schedule 13E-3. SEC Schedule 13E-3 is a critical regulatory filing required by the securities and Exchange commission (SEC) for companies engaging in tender offers or going-private transactions. This schedule provides important information to shareholders and ensures transparency throughout the process.SEC Schedule 13E-3. Welcome to Viewpoint, the new platform that replaces Inform. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory. J. If the tender offer disclosed on this statement involves a going-private transaction, a combined Schedule TO (§ 240.14d-100) and Schedule 13E-3 (§ 240.13e-100) may be filed with the Commission under cover of Schedule TO. The Rule 13e-3 box on the cover page of the Schedule TO must be checked to indicate a combined filing.Introduction . This Amendment No. 10 (the “Final Amendment”) to Rule 13E-3 Transaction Statement on Schedule 13E-3, together with the exhibits thereto (the “Transaction Statement”), is being filed with the Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (together . 1. Purpose and Overview of SEC Schedule 13E-3. SEC Schedule 13E-3 is a critical regulatory filing required by the securities and Exchange commission (SEC) for companies engaging in tender offers or going-private transactions. This schedule provides important information to shareholders and ensures transparency throughout the process.SEC Schedule 13E-3. Welcome to Viewpoint, the new platform that replaces Inform. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.M&A lawyers can use this description to draft SEC Schedule 13e-3 forms for shareholders whose shares will be delisted because of a going private transaction.

1. SEC Schedule 13E-3: An Overview. sec Schedule 13E-3 plays a crucial role in the disclosure process for certain types of transactions, particularly those involving mergers, acquisitions, or other significant corporate events.This schedule requires companies to provide detailed information about the transaction and its impact on . Generally, parties to a going private transaction subject to Rule 13e-3 must file a Schedule 13E-3, 17 CFR 240.13e-100, with the SEC and amend or update the filing as necessary. The Schedule 13E-3 .The Filing Persons are filing this Schedule 13E-3 because the ADS Purchase, in light of the formation of the Consortium and the Proposed Transaction, may be viewed as a step in a series of transactions having the reasonable likelihood or purpose of producing, directly or indirectly, one or more of the effects set forth in Rule 13e-3(a)(3)(ii .

INTRODUCTION . This Rule 13e-3 transaction statement on Schedule 13E-3, together with the exhibits hereto (this “Transaction Statement”), is being filed with the United States Securities and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), jointly by the .

Schedule 13E-3 will include the proxy statement used to solicit target shareholder approval for the transaction, and must be filed prior to the beginning of the process of soliciting target shareholder approval. As Rule 13e-3 was designed to protect minority shareholders, the disclosure regarding the fairness of the transaction is likely to .We estimate that the Schedule 13E-3 cost is $400 per hour ($400 x 103.06 hours per response x 100 responses) for a total cost of $4,122,400 is prepared by an outside law firm hired by the company. The estimated cost burden made solely for purposes of the Paperwork Reduction Act. 14. Costs to Federal Government. This Schedule requires detailed information addressing whether the filing person believes the transaction is fair to unaffiliated security holders and why. Schedule 13E-3 can be combined with Schedule TO, in which case the Rule 13e-3 box on the cover page to Schedule TO must be checked. 14300 CASH OFFER FINANCIAL .

A tabela a seguir mostra estatísticas dos sorteios realizados nos últimos concursos, com dados atualizados até o sorteio do dia 22/02/2024. Número de sorteios: Aparições. .

schedule 13e 3|13e 3 transaction statement